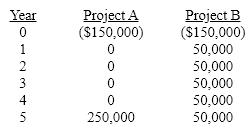

The projected cash flows for two mutually exclusive projects are as follows:  If the cost of capital is 10%, the decidedly more favorable project is:

If the cost of capital is 10%, the decidedly more favorable project is:

A) project B with an NPV of $39,539 and an IRR of 19.9%.

B) project A with an NPV of $5,230 and an IRR of 10.8%.

C) project A with an NPV of $39,539 and an IRR of 10.8%.

D) project B with an NPV of $5,230 and an IRR of 19.9%.

Correct Answer:

Verified

Q76: A project requires an initial outlay of

Q77: A project has the following cash flows:

Q78: J&J Manufacturing is considering a project with

Q79: Capital rationing:

A)is a technique for allocating scarce

Q80: An investment project requires an outlay of

Q82: The future cash flows of a stand-alone

Q83: Williamson Inc. is considering a project with

Q84: The future cash flows of a stand-alone

Q85: A stand-alone capital project has the following

Q86: The future cash flows of a stand-alone

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents