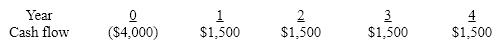

The future cash flows of a stand-alone capital project are:  If the firm's cost of capital is 12%, which of the following statements is true?

If the firm's cost of capital is 12%, which of the following statements is true?

A) The NPV is > $0 and the IRR is less than 12.5%.

B) The NPV is.

C) The NPV is > $0 and the IRR is approximately 18.5%.

D) The NPV is

Correct Answer:

Verified

Q81: The projected cash flows for two mutually

Q82: The future cash flows of a stand-alone

Q83: Williamson Inc. is considering a project with

Q84: The future cash flows of a stand-alone

Q85: A stand-alone capital project has the following

Q87: You are considering the following 2 mutually

Q88: A project is expected to last ten

Q89: What is the internal rate of return

Q90: What is the IRR of a project

Q91: The following projects are all characterized by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents