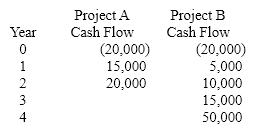

You are considering the following 2 mutually exclusive projects. Using the equivalent annual annuity method and a cost of capital of 10%, which project should be selected? (Round to nearest $)

A) Project B because of an EAA of $12,060

B) Project A because of an EAA of $5,857

C) Project B because of an EAA of $38,320

D) Project A because of an EAA of $10,165

Correct Answer:

Verified

Q82: The future cash flows of a stand-alone

Q83: Williamson Inc. is considering a project with

Q84: The future cash flows of a stand-alone

Q85: A stand-alone capital project has the following

Q86: The future cash flows of a stand-alone

Q88: A project is expected to last ten

Q89: What is the internal rate of return

Q90: What is the IRR of a project

Q91: The following projects are all characterized by

Q92: A project having a payback period of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents