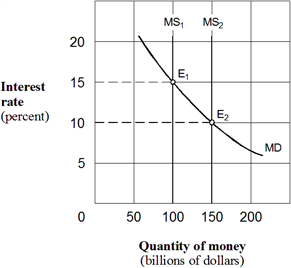

Exhibit 20-3 Money market demand and supply curves  In Exhibit 20-3, assume an equilibrium at E2 with the money supply at $100 billion and the interest rate at 15 percent. The Fed uses its policy tools to move the economy to a new equilibrium at E1 with a money supply of 150 billion and an interest rate of 10 percent. As part of the adjustment to the new equilibrium, we would expect the:

In Exhibit 20-3, assume an equilibrium at E2 with the money supply at $100 billion and the interest rate at 15 percent. The Fed uses its policy tools to move the economy to a new equilibrium at E1 with a money supply of 150 billion and an interest rate of 10 percent. As part of the adjustment to the new equilibrium, we would expect the:

A) price of bonds to rise.

B) price of bonds to remain unchanged.

C) price of bonds to fall.

D) none of the above.

Correct Answer:

Verified

Q30: When the Fed reduces the money supply,

Q104: An increase in the money supply

A) lowers

Q109: A decrease in the money supply

A) lowers

Q110: A decrease in the money supply:

A) raises

Q111: If the Fed reduces the discount rate,

Q112: Suppose that the Fed makes a $100

Q113: Exhibit 20-2 Money market demand and supply curves

Q115: Exhibit 20-3 Money market demand and supply curves

Q116: The impact of an increase in the

Q118: Which of the following is the objective

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents