Instruction 3-1

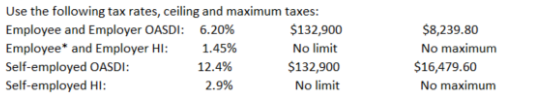

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

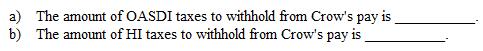

Refer to Instruction 3-1 . Crow earned $585.15 during the week ended March 1, 20--. Prior to payday, Crow had cumulative gross earnings of $4,733.20.

Correct Answer:

Verified

Q72: Instruction 3-1 Q73: Part-time employees pay a FICA tax at Q74: Instruction 3-1 Q75: Once a person reaches the age of Q76: Year-end bonuses paid to employees are not Q78: A child working for his father's corporation Q79: Under FICA, employers must collect the employee's Q80: Instruction 3-1 Q81: A monthly depositor's employment taxes total $3,800 Q82: Self-employed persons who also work other jobs![]()

Use the following tax rates,

Use the following tax rates,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents