Instruction 3-1

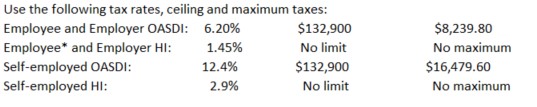

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

Refer to Instruction 3-1 . On the last weekly pay of the first quarter, Lorenz is paid her current pay of $90 per day for four days worked and one day sick pay (total-$450). She is also paid her first quarter commission of $1,200 in this pay. How much will be deducted for:

Correct Answer:

Verified

Q67: Instruction 3-1 Q68: Instruction 3-1 Q69: Employer contributions for retirement plan payments for Q70: Under FICA, each partner in a partnership Q71: Instruction 3-1 Q73: Part-time employees pay a FICA tax at Q74: Instruction 3-1 Q75: Once a person reaches the age of Q76: Year-end bonuses paid to employees are not Q77: Instruction 3-1 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

Use the following tax rates,![]()