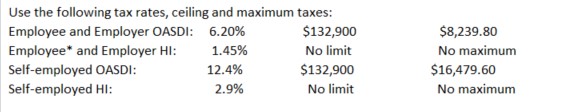

Instruction 3-1  *Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

Refer to Instruction 3-1 . Jax Company's (a monthly depositor) tax liability (amount withheld from employees' wages for federal income tax and FICA tax plus the company's portion of the FICA tax) for July was $1,210.

No deposit was made by the company until August 24, 20-- (9 days late). Determine:

a) The date by which the deposit should have been made

b) The penalty for failure to make timely deposit

c) The penalty for failure to fully pay tax when due

d) The interest on taxes due and unpaid (assume a 5% interest rate)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Instruction 3-1

Use the following tax rates,

Q63: Instruction 3-1 Q64: Lidge Company of Texas (TX) is classified Q65: If on any day during a deposit Q66: Instruction 3-1 Q68: Instruction 3-1 Q69: Employer contributions for retirement plan payments for Q70: Under FICA, each partner in a partnership Q71: Instruction 3-1 Q72: Instruction 3-1 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()

![]()