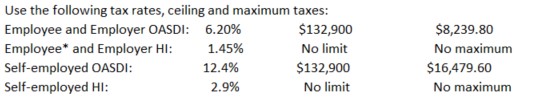

Instruction 3-1  *Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

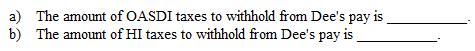

Refer to Instruction 3-1 . Dee is paid $2,345 on November 8, 20--. Dee had cumulative gross earnings, including overtime pay, of $131,600 prior to this pay.

Correct Answer:

Verified

Q58: Employers file Form 941 with the IRS

Q59: FICA defines all of the following as

Q60: Which of the following deposit requirements pertains

Q61: Employees and independent contractors pay different FICA

Q62: Instruction 3-1

Use the following tax rates,

Q64: Lidge Company of Texas (TX) is classified

Q65: If on any day during a deposit