Instruction 3-1

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

Refer to Instruction 3-1 . In this pay, Moss Company deducted OASDI taxes of $5,276.24 and HI taxes of $1,233.95 from the $85,100.90 of taxable wages paid. What is Moss Company's portion of the social security taxes for:

a) OASDI

b) HI

Correct Answer:

Verified

Q61: Employees and independent contractors pay different FICA

Q62: Instruction 3-1

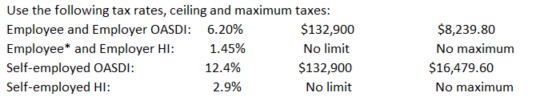

Use the following tax rates,

Q63: Instruction 3-1 Q64: Lidge Company of Texas (TX) is classified Q65: If on any day during a deposit Q67: Instruction 3-1 Q68: Instruction 3-1 Q69: Employer contributions for retirement plan payments for Q70: Under FICA, each partner in a partnership Q71: Instruction 3-1 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()