Instruction 3-1

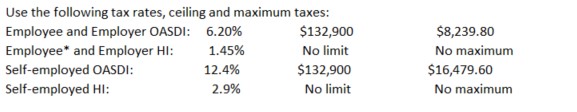

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

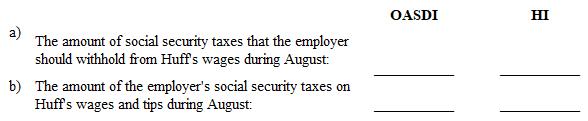

Refer to Instruction 3-1 . On August 1, Huff (part-time waitress) reported on Form 4070 the cash tips of $158.50 that she received in July. During August, Huff was paid wages of $550 by her employer. Determine:

Correct Answer:

Verified

Q63: Instruction 3-1 Q64: Lidge Company of Texas (TX) is classified Q65: If on any day during a deposit Q66: Instruction 3-1 Q67: Instruction 3-1 Q69: Employer contributions for retirement plan payments for Q70: Under FICA, each partner in a partnership Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()