Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

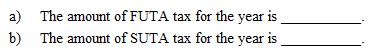

Refer to Instruction 5-1 . Stys Company's payroll for the year is $1,210,930. Of this amount, $510,710 is for wages paid in excess of $7,000 to each individual employee. The SUTA tax rate for the company is 3.2% on the first $7,000 of each employee's earnings.

Correct Answer:

Verified

Q44: An employer must pay the quarterly FUTA

Q45: Instruction 5-1

Use the net FUTA tax

Q46: In order to avoid a credit reduction

Q47: An aspect of the interstate reciprocal arrangement

Q48: A federal unemployment tax is levied on:

A)

Q50: For FUTA purposes, an employer can be

Q51: Instruction 5-1

Use the net FUTA tax

Q52: Instruction 5-1

Use the net FUTA tax

Q53: If the employer is tardy in paying

Q54: Which of the following payments are taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents