Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

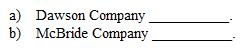

Refer to Instruction 5-1 . Michael Mirer worked for Dawson Company for six months this year and earned $11,200. The other six months he earned $6,900 working for McBride Company (a separate company). The amount of FUTA taxes to be paid on Mirer's wages by the two companies is:

Correct Answer:

Verified

Q40: "Dumping" is legal in all but a

Q41: Voluntary contributions to a state's unemployment department

Q42: Included under the definition of employees for

Q43: When making a payment of FUTA taxes,

Q44: An employer must pay the quarterly FUTA

Q46: In order to avoid a credit reduction

Q47: An aspect of the interstate reciprocal arrangement

Q48: A federal unemployment tax is levied on:

A)

Q49: Instruction 5-1

Use the net FUTA tax

Q50: For FUTA purposes, an employer can be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents