Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

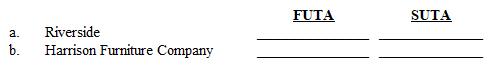

Refer to Instruction 5-1 . Ted Carman worked for Rivertide Country Club and earned $28,500 during the year. He also worked part time for Harrison Furniture Company and earned $12,400 during the year. The SUTA tax rate for Rivertide Country Club is 4.2% on the first $8,000, and the rate for Harrison Furniture Company is 5.1% on the first $8,000. Calculate the FUTA and SUTA taxes paid by the employers on Carman's earnings.

Correct Answer:

Verified

Q68: In the case of an employee who

Q69: FUTA coverage does not include service of

Q70: Instruction 5-1

Use the net FUTA tax

Q71: Instruction 5-1

Use the net FUTA tax

Q72: A bonus paid as remuneration for services

Q74: The federal unemployment tax is imposed on

Q75: If an employer's FUTA tax liability for

Q76: Employer contributions made to employees' 401(k) plans

Q77: The location of the employee's residence is

Q78: Educational assistance payments to workers are considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents