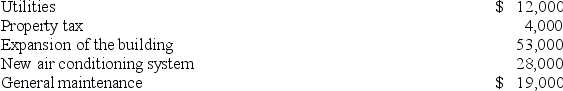

Ryan Company purchased a building on January 1, 2018, for $250,000. In addition, during 2018 the following costs related to the building have been incurred:  The amount of expenditures to capitalize for the year (not including the initial purchase of the building) is:

The amount of expenditures to capitalize for the year (not including the initial purchase of the building) is:

A) $35,000.

B) $85,000.

C) $81,000.

D) $72,000.

Correct Answer:

Verified

Q98: On January 3, 2018, Tracer Incorporated purchased

Q99: A change in the estimated useful life

Q100: An asset should be written down if

Q101: In testing for recoverability of property, plant,

Q102: An impairment loss has the effect of:

A)

Q104: In 2017, Antle Inc. had acquired Demski

Q105: Alou Corporation reported the following information at

Q106: Calloway Shoes purchased a delivery truck on

Q107: Accounting for impairment losses:

A) Involves a two-step

Q108: Oak Inc. has the following information regarding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents