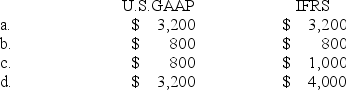

Calloway Shoes purchased a delivery truck on September 30, 2018, for $32,000. The estimated useful life of the truck is 10 years with no residual value. After five years, the refrigeration unit will need to be replaced. The $8,000 cost of the unit is included in the cost of the truck. Calloway uses the straight-line depreciation method. Depreciation for 2018 under U.S. GAAP and International Financial Reporting Standards (IFRS) , respectively, is:

A) option A

B) option B

C) option C

D) option D

Correct Answer:

Verified

Q101: In testing for recoverability of property, plant,

Q102: An impairment loss has the effect of:

A)

Q103: Ryan Company purchased a building on January

Q104: In 2017, Antle Inc. had acquired Demski

Q105: Alou Corporation reported the following information at

Q107: Accounting for impairment losses:

A) Involves a two-step

Q108: Oak Inc. has the following information regarding

Q109: Which of the following types of subsequent

Q110: The amount of impairment loss is the

Q111: At the end of its 2018 fiscal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents