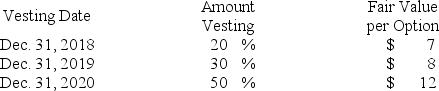

Green Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2018, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting) . The fair value of the options is estimated as follows:  Assuming Green uses the straight-line method, what is the compensation expense related to the options to be recorded in 2019?

Assuming Green uses the straight-line method, what is the compensation expense related to the options to be recorded in 2019?

A) $130,667.

B) $200,000.

C) $333,333.

D) $400,000.

Correct Answer:

Verified

Q122: On October 1, 2018, Iona Frisbee Co.

Q123: A company is said to have a

Q124: Regardless of the form of share-based compensation,

Q125: January 1, 2018, Woody Forrest Corporation granted

Q126: On January 1, 2018, Wendy Day Co.

Q128: Executive stock options:

A) allow the holder the

Q129: On January 1, 2018, Felix Austead Athletic

Q130: Common forms of share-based compensation include each

Q131: Red Company is a calendar-year U.S. firm

Q132: For a firm with a simple capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents