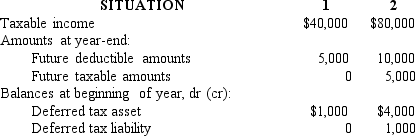

Two independent situations are described below.Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

The enacted tax rate is 40% for both situations.

Required:

For each situation determine the:

(a. )Income tax payable currently.

(b. )Deferred tax asset - balance at year-end.

(c. )Deferred tax asset change dr or (cr)for the year.

(d. )Deferred tax liability - balance at year-end.

(e. )Deferred tax liability change dr or (cr)for the year.

(f. )Income tax expense for the year.

Correct Answer:

Verified

Q129: Gallo Light began operations in 2016.The company

Q132: Gore Company,organized on January 2,2016,had pretax accounting

Q133: The information that follows pertains to Julia

Q135: The following information is for James Industries'

Q138: The information below pertains to Mondavi Corporation:

(a.

Q141: In the current year, Bruno Corporation collected

Q142: In LMC's 2018 annual report to shareholders,

Q153: At the end of the prior year,

Q157: In LMC's 2018 annual report to shareholders,

Q159: At the end of the preceding year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents