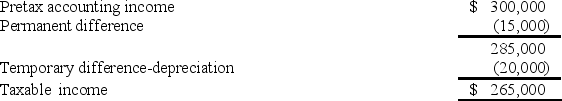

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

-What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

A) $35,000.

B) $20,000.

C) $14,000.

D) $8,000.

Correct Answer:

Verified

Q30: The following information relates to Franklin Freightways

Q31: Isaac Inc. began operations in January 2018.

Q32: Which of the following usually results in

Q33: The following information relates to Franklin Freightways

Q34: For its first year of operations, Tringali

Q36: Which of the following differences between financial

Q37: The following information relates to Franklin Freightways

Q38: Brady's listing of deferred tax assets and

Q39: Which of the following differences between financial

Q40: In the statement of cash flows, by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents