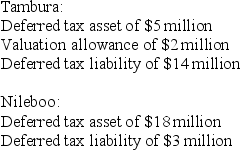

Brady's listing of deferred tax assets and liabilities includes the following for operations in the tax jurisdictions of Tambura and Nileboo:

- Brady files separate tax returns in Tambura and Nileboo. Brady's balance sheet would include the following disclosure of deferred tax assets and liabilities:

A) A deferred tax asset of $4 million.

B) A deferred tax liability of $17 million and a deferred tax asset of $21 million.

C) A deferred tax liability of $11 million and a deferred tax asset of $15 million.

D) A deferred tax liability of $19 million and a deferred tax asset of $23 million.

Correct Answer:

Verified

Q33: The following information relates to Franklin Freightways

Q34: For its first year of operations, Tringali

Q35: For its first year of operations, Tringali

Q36: Which of the following differences between financial

Q37: The following information relates to Franklin Freightways

Q39: Which of the following differences between financial

Q40: In the statement of cash flows, by

Q41: Plutonic Inc. had $400 million in taxable

Q42: Alamo Inc. had $300 million in taxable

Q43: A deferred tax asset represents a:

A) Future

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents