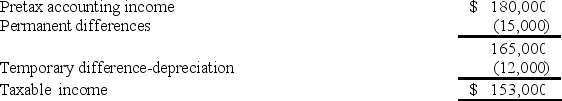

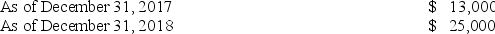

Information for Kent Corp. for the year 2018: Reconciliation of pretax accounting income and taxable income:  Cumulative future taxable amounts all from depreciation temporary differences:

Cumulative future taxable amounts all from depreciation temporary differences:  The enacted tax rate was 30% for 2017 and thereafter.

The enacted tax rate was 30% for 2017 and thereafter.

-

What should be the balance in Kent's deferred tax liability account as of December 31, 2018?

A) $5,200.

B) $7,500.

C) $25,000.

D) None of these answer choices are correct.

Correct Answer:

Verified

Q44: At the end of the current year,

Q45: Using straight-line depreciation for financial reporting purposes

Q46: Which of the following usually results in

Q47: Of the following temporary differences, which one

Q48: Wayne Co. had a decrease in deferred

Q50: Information for Kent Corp. for the year

Q51: In 2018, Magic Table Inc. decides to

Q52: Which of the following differences between financial

Q53: Information for Kent Corp. for the year

Q54: During the current year, Stern Company had

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents