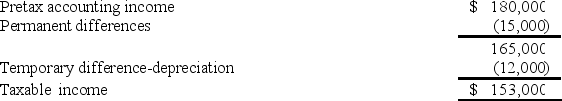

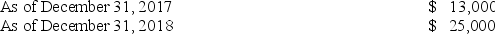

Information for Kent Corp. for the year 2018: Reconciliation of pretax accounting income and taxable income:  Cumulative future taxable amounts all from depreciation temporary differences:

Cumulative future taxable amounts all from depreciation temporary differences:  The enacted tax rate was 30% for 2017 and thereafter.

The enacted tax rate was 30% for 2017 and thereafter.

-

What would Kent's income tax expense be in the year 2018?

A) $42,300.

B) $45,900.

C) $49,500.

D) None of these answer choices are correct.

Correct Answer:

Verified

Q48: Wayne Co. had a decrease in deferred

Q49: Information for Kent Corp. for the year

Q50: Information for Kent Corp. for the year

Q51: In 2018, Magic Table Inc. decides to

Q52: Which of the following differences between financial

Q54: During the current year, Stern Company had

Q55: A magazine publisher collects one year in

Q56: Which of the following circumstances creates a

Q57: Woody Corp. had taxable income of $8,000

Q58: Which of the following creates a deferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents