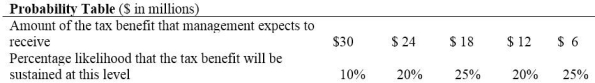

Brook Company has taken a position on its tax return to claim a tax credit of $30 million (direct reduction in taxes payable) and has determined that its sustainability is "more likely than not" based on its technical merits. Brook's management has developed the probability table shown below of all possible material outcomes:  Brook's taxable income is $300 million for the year, and its effective tax rate is 40%. The tax credit would be a direct reduction in current taxes payable.

Brook's taxable income is $300 million for the year, and its effective tax rate is 40%. The tax credit would be a direct reduction in current taxes payable.

Required:

1. At what amount would Brook measure the tax benefit in its income statement?

2. Prepare the appropriate journal entry for Brook to record its income taxes for the year.

Correct Answer:

Verified

Probability table:

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q166: How are deferred tax assets and deferred

Q167: Sometimes a temporary difference will produce future

Q168: When a new tax rate is enacted,

Q169: Four independent situations are described below. Each

Q170: What events create permanent differences between accounting

Q171: How are deferred tax assets arising from

Q172: The way companies deal with uncertainty in

Q173: Cabot Company reported a pretax operating

Q174: What disclosures for deferred taxes, pertaining to

Q175: What is a valuation allowance for deferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents