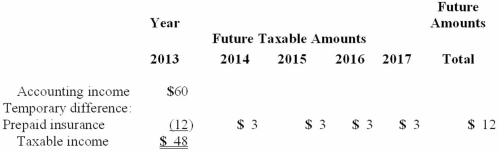

The following information is for Hulk Gyms' first year of operations. Amounts are in millions of dollars. The enacted tax rate is 30%.  Required:

Required:

Prepare a compound journal entry to record the income tax expense for the year 2013. Show well-labeled computations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Before considering a net operating loss carryforward

Q103: What is Hobson's income tax payable for

Q105: Estimate the effective tax rate for Black

Q107: Several years ago, Western Electric Corp. purchased

Q109: Typical Corp. reported a deferred tax liability

Q141: In the current year, Bruno Corporation collected

Q142: In LMC's 2018 annual report to shareholders,

Q152: Pocus, Inc., reports warranty expense when related

Q153: At the end of the prior year,

Q158: At the end of its first year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents