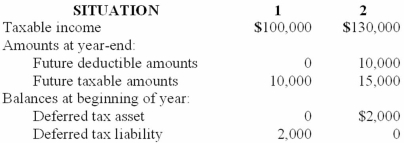

Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:  The enacted tax rate is 40% for both situations.

The enacted tax rate is 40% for both situations.

Required:

For each situation determine the:

(a.) Income tax payable currently.

(b.) Deferred tax asset - balance at year-end.

(c.) Deferred tax asset change dr or (cr) for the year.

(d.) Deferred tax liability - balance at year-end.

(e.) Deferred tax liability change dr or (cr) for the year.

(f.) Income tax expense for the year.

Correct Answer:

Verified

Q138: Tobac Company reported a pretax operating loss

Q139: Patterson Development sometimes sells property on an

Q140: Tobac Company reported an operating loss of

Q142: Listed below are five independent situations. For

Q161: Some accountants believe that deferred taxes should

Q162: Why are differences in reported amounts for

Q163: Identify three examples of permanent differences between

Q164: What argument serves as the basis for

Q168: When a new tax rate is enacted,

Q175: What is a valuation allowance for deferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents