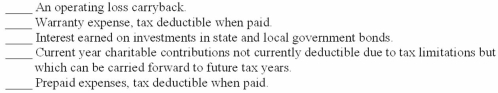

Listed below are five independent situations. For each situation indicate (by letter) whether it will create (A) a deferred tax asset, (L) a deferred tax liability, or (N) neither.

Correct Answer:

Verified

Q137: Two independent situations are described below. Each

Q138: Tobac Company reported a pretax operating loss

Q139: Patterson Development sometimes sells property on an

Q140: Tobac Company reported an operating loss of

Q143: Listed below are five independent situations. For

Q162: Why are differences in reported amounts for

Q168: When a new tax rate is enacted,

Q172: The way companies deal with uncertainty in

Q174: What disclosures for deferred taxes, pertaining to

Q175: What is a valuation allowance for deferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents