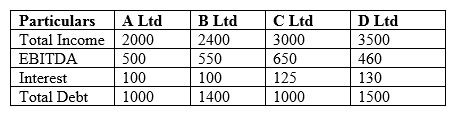

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:  Two credit analysts are discussing the DM-approach to credit risk modeling. They make the following statements: Analyst A: A portfolio's standard deviation of credit losses can be determined by considering the standard deviation of credit losses of individual exposures in the portfolio and summing them all up. Analyst B: I do not fully agree with that. Apart from individual standard deviations, one also needs to consider the correlation of the exposure with the rest of the portfolio so as to account for diversification effects. Higher correlations among credit exposures will lead to higher standard deviation of the overall portfolio.

Two credit analysts are discussing the DM-approach to credit risk modeling. They make the following statements: Analyst A: A portfolio's standard deviation of credit losses can be determined by considering the standard deviation of credit losses of individual exposures in the portfolio and summing them all up. Analyst B: I do not fully agree with that. Apart from individual standard deviations, one also needs to consider the correlation of the exposure with the rest of the portfolio so as to account for diversification effects. Higher correlations among credit exposures will lead to higher standard deviation of the overall portfolio.

A) Only Analyst A is correct

B) Both are correct

C) Only Analyst B is correct

D) Both are incorrect

Correct Answer:

Verified

Q2: Following is information related banks: Auckland Ltd

Q3: Satish Dhawan, a veteran fixed income trader

Q4: "Following four entities operate in the Indian

Q5: Scott is a credit analyst with one

Q6: The longer the term to maturity of

Q8: Mr. Gopi, while teaching the CCRA course

Q9: The following information pertains to bonds:

Q10: The following information pertains to bonds:

Q11: Following is information related banks: Auckland Ltd

Q12: Satish Dhawan, a veteran fixed income trader

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents