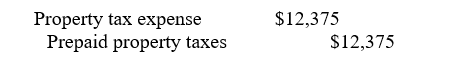

Eldora, Inc. paid property taxes of $16,500 on June 30, 2012, for the period July 1, 2012, to June 30, 2013, and debited prepaid property tax expense. Eldora, Inc. uses a fiscal year end of September 30 for financial purposes. What journal entry should be made to recognize property tax expense for the period October 1, 2012, to June 30, 2013?

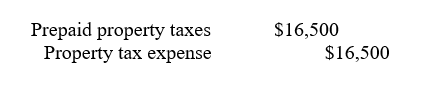

A)

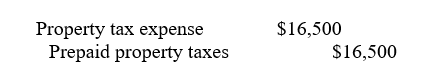

B)

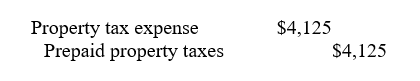

C)

D)

Correct Answer:

Verified

Q46: Which of the following types of advertising

Q47: Which of the following expenditures should be

Q48: Eldora, Inc. paid property taxes of $16,500

Q49: What makes environmental liabilities unique among contingent

Q50: On December 31, the trial balance of

Q52: Marino, Inc. makes a sale and collects

Q53: A footnote disclosure only is required if

Q54: Which of the following is the appropriate

Q55: On June 1, Jenni invested $4,000 into

Q56: Which of the following is the required

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents