On June 1, Jenni invested $4,000 into a mutual fund. By December 31, the value of the mutual fund had decreased to $3,200. Jenni did not sell any portion of the mutual fund during the year. Assuming Jenni's income tax rate on this investment will be 35%, the journal entry to record the income tax expense is

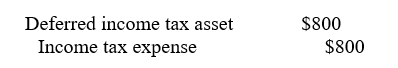

A)

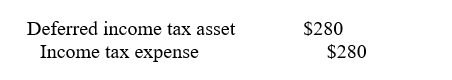

B)

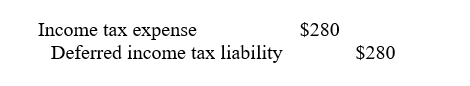

C)

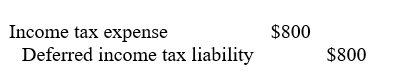

D)

Correct Answer:

Verified

Q50: On December 31, the trial balance of

Q51: Eldora, Inc. paid property taxes of $16,500

Q52: Marino, Inc. makes a sale and collects

Q53: A footnote disclosure only is required if

Q54: Which of the following is the appropriate

Q56: Which of the following is the required

Q57: No disclosure is required for contingent liabilities

Q58: A contingent liability is recorded by making

Q59: Marino, Inc. makes a sale and collects

Q60: The general rule for advertising costs is

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents