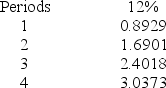

Butler Corporation is considering the purchase of new equipment costing $30,000.The projected annual after-tax net income from the equipment is $1,200,after deducting $10,000 for depreciation.The revenue is to be received at the end of each year.The machine has a useful life of 3 years and no salvage value.Butler requires a 12% return on its investments.The present value of an annuity of $1 for different periods follows:

-What is the net present value of the machine?

A) $24,018.

B) $(3,100) .

C) $30,000.

D) $26,900.

E) $(29,520) .

Correct Answer:

Verified

Q68: The hurdle rate is often set at:

A)

Q68: The expected amount of time to recover

Q79: A disadvantage of using the payback period

Q84: A company can buy a machine that

Q103: Alfarsi Industries uses the net present value

Q106: A company is considering a 5-year project.The

Q107: A machine costs $180,000 and will have

Q107: Alfarsi Industries uses the net present value

Q108: Tressor Company is considering a 5-year project.The

Q109: Poe Company is considering the purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents