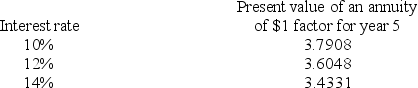

Tressor Company is considering a 5-year project.The company plans to invest $90,000 now and it forecasts cash flows for each year of $27,000.The company requires that investments yield a discount rate of at least 14%.Selected factors for a present value of an annuity of $1 for five years are shown below:  Calculate the internal rate of return to determine whether it should accept this project.

Calculate the internal rate of return to determine whether it should accept this project.

A) The project should be accepted because it will earn more than 14%.

B) The project should be accepted because it will earn more than 10%.

C) The project will earn more than 12% but less than 14%.At a hurdle rate of 14%,the project should be rejected.

D) The project should be rejected because it will earn less than 14%.

E) The project should be rejected because it will not earn exactly 14%.

Correct Answer:

Verified

Q103: Alfarsi Industries uses the net present value

Q104: Butler Corporation is considering the purchase of

Q104: A new manufacturing machine is expected to

Q106: A company is considering a 5-year project.The

Q107: Alfarsi Industries uses the net present value

Q107: A machine costs $180,000 and will have

Q109: Poe Company is considering the purchase of

Q110: Alfarsi Industries uses the net present value

Q112: The following present value factors are provided

Q113: A company is considering the purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents