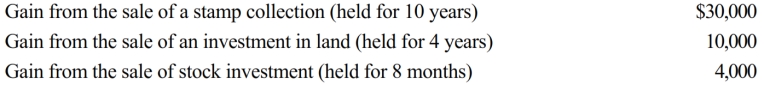

Perry is in the 32% tax bracket. During 2018, he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

A) (15% × $30,000) + (32% × $4,000) .

B) (15% × $10,000) + (28% × $30,000) + (32% × $4,000) .

C) (0% × $10,000) + (28% × $30,000) + (32% × $4,000) .

D) (15% × $40,000) + (32% × $4,000) .

E) None of these.

Correct Answer:

Verified

Q114: Helen, age 74 and a widow, is

Q115: In 2018, Tom is single and has

Q116: During 2018, Trevor has the following capital

Q117: During 2018, Jackson had the following capital

Q118: For the current year, David has wages

Q120: Michaella, age 23, is a full-time law

Q122: Lena is 66 years of age, single,

Q123: Deductions for AGI are often referred to

Q147: In satisfying the support test and the

Q154: When married persons file a joint return,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents