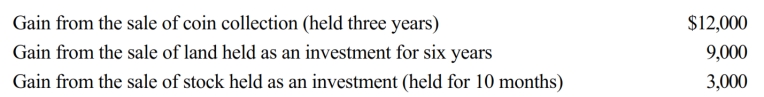

During 2018, Jackson had the following capital gains and losses:

a. How much is Jackson's tax liability if he is in the 12% tax bracket?

b. If his tax bracket is 32% (not 12%)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q112: In 2018, Ashley earns a salary of

Q113: Ashley had the following transactions during 2017:

Q114: Helen, age 74 and a widow, is

Q115: In 2018, Tom is single and has

Q116: During 2018, Trevor has the following capital

Q118: For the current year, David has wages

Q119: Perry is in the 32% tax bracket.

Q120: Michaella, age 23, is a full-time law

Q122: Lena is 66 years of age, single,

Q154: When married persons file a joint return,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents