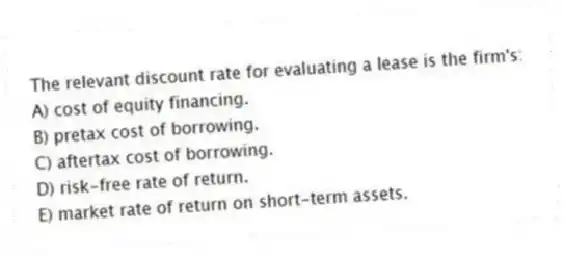

The relevant discount rate for evaluating a lease is the firm's:

A) cost of equity financing.

B) pretax cost of borrowing.

C) aftertax cost of borrowing.

D) risk-free rate of return.

E) market rate of return on short-term assets.

Correct Answer:

Verified

Q25: What does the IRS require if lease

Q26: Which one of these is considered to

Q27: Which one of the following statements is

Q28: Which one of the following is most

Q29: Rodriquez Co. is considering leasing some equipment

Q31: The most cited reason why firms enter

Q32: Which one of the following is an

Q33: The incremental cash flows of leasing consider

Q34: Val's Pizzeria is contemplating leasing versus buying

Q35: Assume the initial present value of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents