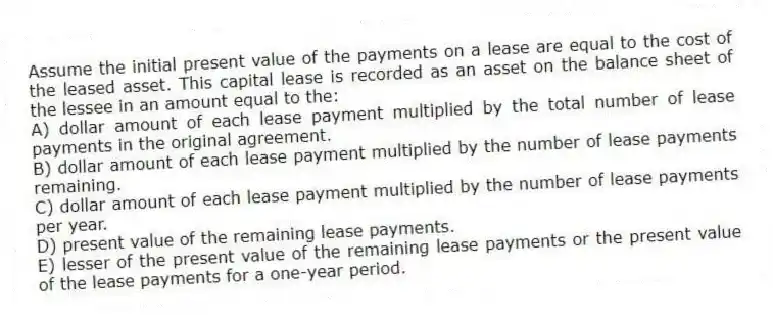

Assume the initial present value of the payments on a lease are equal to the cost of the leased asset. This capital lease is recorded as an asset on the balance sheet of the lessee in an amount equal to the:

A) dollar amount of each lease payment multiplied by the total number of lease payments in the original agreement.

B) dollar amount of each lease payment multiplied by the number of lease payments remaining.

C) dollar amount of each lease payment multiplied by the number of lease payments per year.

D) present value of the remaining lease payments.

E) lesser of the present value of the remaining lease payments or the present value of the lease payments for a one-year period.

Correct Answer:

Verified

Q30: The relevant discount rate for evaluating a

Q31: The most cited reason why firms enter

Q32: Which one of the following is an

Q33: The incremental cash flows of leasing consider

Q34: Val's Pizzeria is contemplating leasing versus buying

Q36: A firm will be indifferent to leasing

Q37: Northern Lights is trying to decide whether

Q38: The Corner Store is evaluating a lease

Q39: You should lease rather than buy when

Q40: The lost depreciation tax shield used in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents