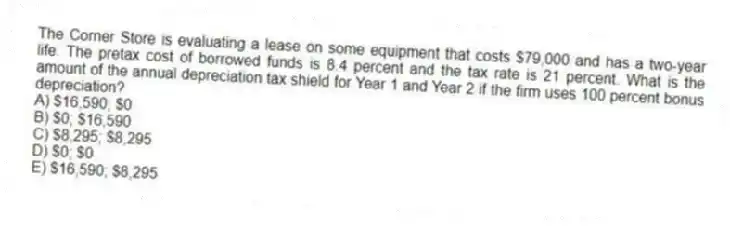

The Corner Store is evaluating a lease on some equipment that costs $79,000 and has a two-year life. The pretax cost of borrowed funds is 8.4 percent and the tax rate is 21 percent. What is the amount of the annual depreciation tax shield for Year 1 and Year 2 if the firm uses 100 percent bonus depreciation?

A) $16,590; $0

B) $0; $16,590

C) $8,295; $8,295

D) $0; $0

E) $16,590; $8,295

Correct Answer:

Verified

Q33: The incremental cash flows of leasing consider

Q34: Val's Pizzeria is contemplating leasing versus buying

Q35: Assume the initial present value of the

Q36: A firm will be indifferent to leasing

Q37: Northern Lights is trying to decide whether

Q39: You should lease rather than buy when

Q40: The lost depreciation tax shield used in

Q41: Ft. Myers Marina can lease $31,800 of

Q42: CTS is analyzing the acquisition of $284,000

Q43: MIG Tools can either lease or buy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents