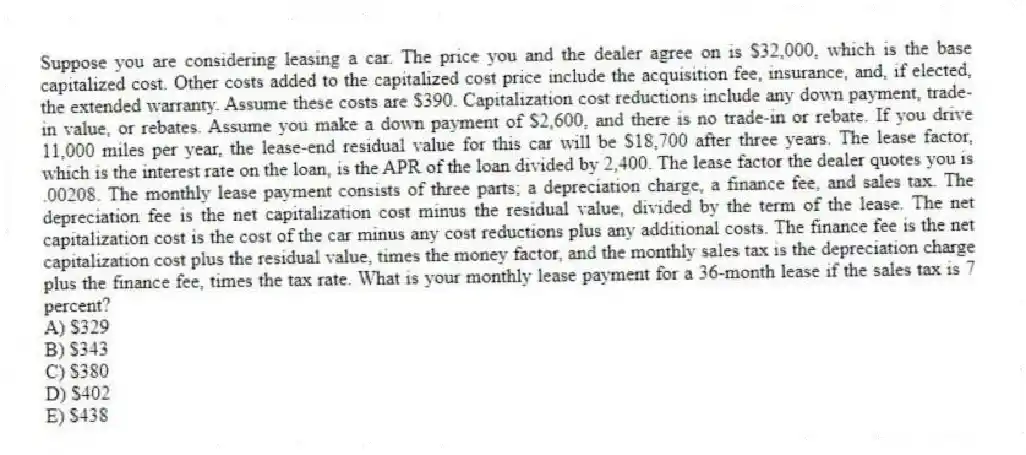

Suppose you are considering leasing a car. The price you and the dealer agree on is $32,000, which is the base capitalized cost. Other costs added to the capitalized cost price include the acquisition fee, insurance, and, if elected, the extended warranty. Assume these costs are $390. Capitalization cost reductions include any down payment, trade-in value, or rebates. Assume you make a down payment of $2,600, and there is no trade-in or rebate. If you drive 11,000 miles per year, the lease-end residual value for this car will be $18,700 after three years. The lease factor, which is the interest rate on the loan, is the APR of the loan divided by 2,400. The lease factor the dealer quotes you is .00208. The monthly lease payment consists of three parts; a depreciation charge, a finance fee, and sales tax. The depreciation fee is the net capitalization cost minus the residual value, divided by the term of the lease. The net capitalization cost is the cost of the car minus any cost reductions plus any additional costs. The finance fee is the net capitalization cost plus the residual value, times the money factor, and the monthly sales tax is the depreciation charge plus the finance fee, times the tax rate. What is your monthly lease payment for a 36-month lease if the sales tax is 7 percent?

A) $329

B) $343

C) $380

D) $402

E) $438

Correct Answer:

Verified

Q61: If your firm purchases a machine costing

Q62: Wildcat Oil Company is trying to decide

Q63: A scanner that costs $2.8 million would

Q64: An asset costs $640,000 and would be

Q65: A machine costs $2.2 million and would

Q66: Frank's Auto can purchase new equipment for

Q67: A machine that will be worthless after

Q68: Turner's has decided to modernize its production

Q69: CT Motors borrows money at 8.35 percent,

Q71: Southern Mfg. can save $950,000 in annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents