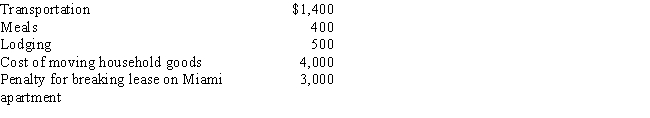

Due to a merger, Allison transfers from Miami to Chicago. Under a new job description, she is reclassified from employee to independent contractor status. Her moving expenses, which are not reimbursed, are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

A) $0.

B) $5,900.

C) $6,100.

D) $8,900.

E) $9,300.

Correct Answer:

Verified

Q65: The § 222 deduction for tuition and

Q85: Which of the following expenses, if any,

Q89: One of the tax advantages of being

Q91: Which, if any, of the following expenses

Q92: In terms of meeting the distance test

Q93: Rachel is single and has a college

Q95: Which, if any, of the following is

Q97: During the year, John went from Milwaukee

Q98: During the year, Walt travels from Seattle

Q99: During the year, Sophie went from Omaha

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents