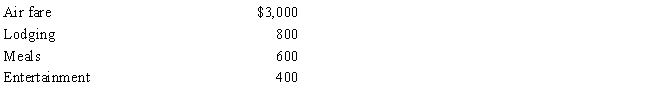

During the year, Sophie went from Omaha to Lima (Peru) on business. She spent four days on business, two days on travel, and four days on vacation. Disregarding the vacation costs, Sophie's unreimbursed expenses are:  Sophie's deductible expenses are:

Sophie's deductible expenses are:

A) $4,300.

B) $3,100.

C) $2,800.

D) $2,500.

E) None of these.

Correct Answer:

Verified

Q65: The § 222 deduction for tuition and

Q94: Due to a merger, Allison transfers from

Q95: Which, if any, of the following is

Q97: During the year, John went from Milwaukee

Q98: During the year, Walt travels from Seattle

Q100: Which, if any, of the following expenses

Q101: After graduating from college, Clint obtained employment

Q104: Rocky has a full-time job as an

Q112: If a business retains someone to provide

Q125: In terms of income tax treatment, what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents