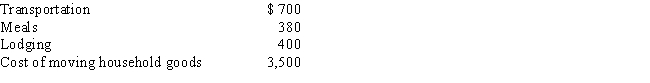

After graduating from college, Clint obtained employment in Omaha. In moving from his parents' home in Baltimore to Omaha, Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Correct Answer:

Verified

Q65: The § 222 deduction for tuition and

Q97: During the year, John went from Milwaukee

Q98: During the year, Walt travels from Seattle

Q99: During the year, Sophie went from Omaha

Q100: Which, if any, of the following expenses

Q104: Rocky has a full-time job as an

Q105: In the current year, Bo accepted employment

Q112: If a business retains someone to provide

Q125: In terms of income tax treatment, what

Q137: Taylor performs services for Jonathan on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents