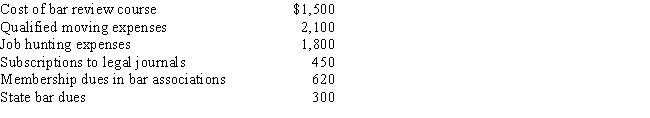

In the current year, Bo accepted employment with a Kansas City law firm after graduating from law school. Her expenses for the year are listed below:

Since Bo worked just part of the year, her salary was only $32,100. In terms of deductions from AGI, how much does Bo have?

Since Bo worked just part of the year, her salary was only $32,100. In terms of deductions from AGI, how much does Bo have?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Which, if any, of the following expenses

Q101: After graduating from college, Clint obtained employment

Q104: Rocky has a full-time job as an

Q106: Myra's classification of those who work for

Q107: During 2017, Eva used her car as

Q109: Meredith holds two jobs and attends graduate

Q110: Paul is employed as an auditor by

Q112: If a business retains someone to provide

Q125: In terms of income tax treatment, what

Q137: Taylor performs services for Jonathan on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents