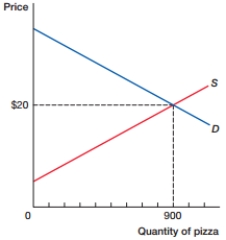

(Figure: Changing Tax Rates) The figure shows a market in equilibrium. The introduction of a tax would likely:

A) decrease tax revenue and decrease deadweight loss.

B) decrease tax revenue and increase deadweight loss.

C) increase tax revenue and decrease deadweight loss.

D) increase tax revenue and increase deadweight loss.

Correct Answer:

Verified

Q44: (Figure: Economic Impact of Taxation) In the

Q45: (Figure: Economic Impact of Taxation) In the

Q46: (Figure: Economic Impact of Taxation)

Q47: (Figure: Economic Impact of Taxation) In the

Q48: The goal of a sales tax is

Q50: (Figure: Changing Tax Rates 0) In the

Q51: (Figure: Changing Tax Rates A) In the

Q52: (Figure: Changing Tax Rates I) In the

Q53: (Figure: Changing Tax Rates Alpha) In the

Q54: In general, the burden of a tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents