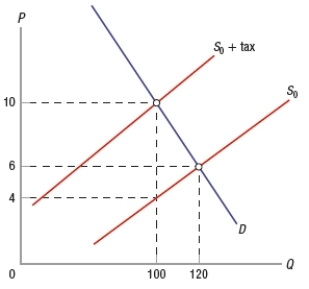

(Figure: Impact of Tax on Market Equilibrium) Based on the graph, how much is the deadweight loss created by the tax?

A) $80

B) $26

C) $60

D) $120

Correct Answer:

Verified

Q234: In general, tax incidence falls more on

Q235: In general, the burden of taxes falls

Q236: If demand is inelastic, the tax incidence

Q237: If demand is elastic, the tax incidence

Q238: (Figure: Impact of Tax on Market Equilibrium)

Q240: (Figure: Impact of Tax on Market Equilibrium)

Q241: Tax incidence describes

A) who makes the tax

Q242: The economic burden of a tax borne

Q243: A tax on a product

A) has no

Q244: Tax incidence usually falls

A) only on consumers.

B)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents