On January 1, 2018, Patagonia Leasing leased equipment to Pebble Services under a finance/sales-type lease designed to earn Patagonia a 12% rate of return for providing long-term financing. The lease agreement specified:

a. Ten annual payments of $110,000 beginning January 1, 2018, the beginning of the lease and each December 31 thereafter through 2026.

b. The estimated useful life of the leased equipment is 10 years with no residual value. Its cost to Patagonia was $632,824.

c. The lease qualifies as a finance lease/sales-type lease.

d. A 10-year service agreement with Mechanics International was negotiated to provide maintenance of the equipment as required. Payments of $10,000 per year are specified, beginning January 1, 2018. Patagonia was to pay this cost as incurred, but lease payments reflect this expenditure.

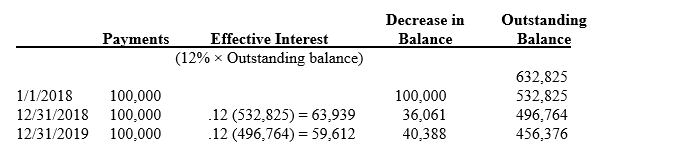

e. A partial amortization schedule, appropriate for both the lessee and lessor, follows:

Required:

Round your answers to the nearest whole dollar amounts.

Prepare the appropriate journal entries for both the lessee and lessor related to the lease on:

1. January 1, 2018.

2. December 31, 2018.

Correct Answer:

Verified

Pebble Services (Lessee)

Right-of-use...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q248: On January 1, 2018, Tennessee Valley Corporation

Q249: The following relate to an operating lease

Q250: The lease agreement and related facts indicate

Q251: What makes up a lessor's net investment?

A)

Q252: Terms of a lease agreement and related

Q254: To raise operating funds, Azure Sailing sold

Q255: On January 1, 2018, McCaffrey Inc. leased

Q256: On January 1, 2018, Marlon's Transport leased

Q257: National Leasing leases equipment to a variety

Q258: On January 1, 2018, Central Industries leased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents