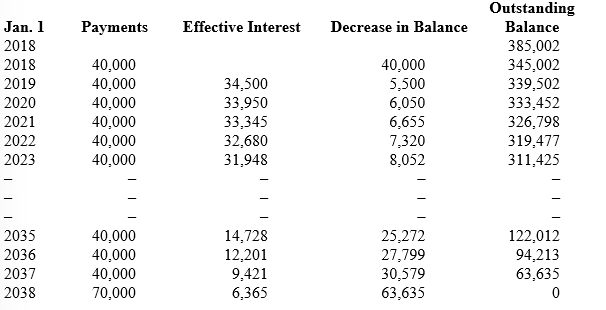

On January 1, 2018, Tennessee Valley Corporation (TVC) leased equipment from Great Lakes Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by TVC. Portions of the Great Lakes Leasing's lease amortization schedule appear below:

Required:

1. What is TVC's lease payable at the beginning of the lease (after the first payment)?

2. What is the lease term in years?

3. What is the asset's residual value expected at the end of the lease term?

4. What is the effective annual interest rate?

5. What is the total amount of lease payments for Great Lakes?

6. What is the total amount of lease payments for TVC?

7. What is Great Lakes' total effective interest revenue recorded over the term of the lease?

8. What amount would TVC record as a right-of-use asset at the beginning of the lease?

Correct Answer:

Verified

Lease Payable

$345,002: ($385,002 - $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q243: Which of the following might shorten the

Q244: Brady Leasing leases mechanical equipment to industrial

Q245: On January 1, 2018, Morris Production leased

Q246: Terms of a lease agreement and related

Q247: Charles River Hospital leased medical equipment from

Q249: The following relate to an operating lease

Q250: The lease agreement and related facts indicate

Q251: What makes up a lessor's net investment?

A)

Q252: Terms of a lease agreement and related

Q253: On January 1, 2018, Patagonia Leasing leased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents