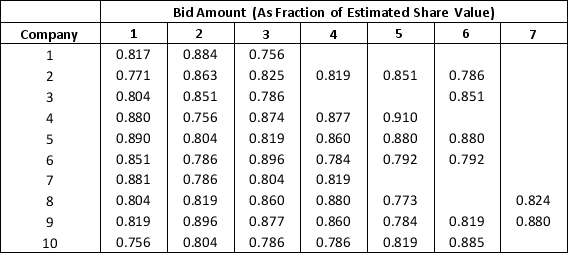

A specialty hedge fund is considering the purchase of a Jackson Pollock painting. It estimates the value of the painting to be $185 million. In an auction, both the number of competing bids and the amount of the competing bids is uncertain. The hedge fund has maintained a file summarizing 10 recent art auctions that it believes are similar to the upcoming auction. It is considering a bid of $163 million and would like to evaluate its chances of winning the upcoming auction with this bid.

a. Construct a spreadsheet simulation model for this auction. Use a discrete uniform distribution between the minimum and maximum number of bidders in the 10 observed auctions to model the number of bidders in the Jackson Pollock auction. Fit a realistic distribution to the bid data to generate values of competing bid amounts. Use ASP to apply simulation optimization to determine the hedge fund's bid amount that maximizes the expected return = P(winning auction)*(185 - bid amount). Hint: Placing reasonable bounds on the highest and lowest possible bid amount will greatly assist the optimization algorithm.

a. Construct a spreadsheet simulation model for this auction. Use a discrete uniform distribution between the minimum and maximum number of bidders in the 10 observed auctions to model the number of bidders in the Jackson Pollock auction. Fit a realistic distribution to the bid data to generate values of competing bid amounts. Use ASP to apply simulation optimization to determine the hedge fund's bid amount that maximizes the expected return = P(winning auction)*(185 - bid amount). Hint: Placing reasonable bounds on the highest and lowest possible bid amount will greatly assist the optimization algorithm.

b. What is the probability that the hedge fund wins the auction if it bids the amount that maximizes its expected return?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: The _ function in Excel is used

Q38: The random variables corresponding to the interarrival

Q41: The manager of a company decides to

Q42: Consider the table below with information regarding

Q43: A branded store has outlets around the

Q45: A football tournament is conducted between Team-A

Q45: An Investment firm offers free financial planning

Q47: Sunseel Industries produces different types of raw

Q48: A tourist bus can accommodate 80 people

Q49: A company has produced a new battery

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents