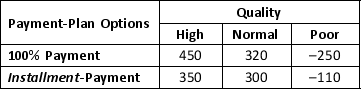

The Golden Jill Mining Company is interested in procuring 10,000 acres of coal mines in Powder River Basin. The mining company is considering two payment-plan options to buy the mines:

I. 100% Payment

II. Installment-Payment

The payoff received will be based on the quality of coal obtained from the mines which has been categorized as High, Normal, and Poor Quality as well as the payment plan. The profit payoff in million dollars resulting from the various combinations of options and quality are provided below:

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem? How many decision alternatives are there? How many outcomes are there for the chance event?

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem? How many decision alternatives are there? How many outcomes are there for the chance event?

b. If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Visual Park is considering marketing one of

Q51: Consider a decision situation with four possible

Q52: The following payoff table shows the profit

Q53: A construction company must decide on the

Q54: Emil Hansen is interested in leasing a

Q55: A Manufacturing company introduces two product alternatives.

Q56: Meega airlines decided to offer direct service

Q57: Three decision makers have assessed payoffs for

Q59: Greentrop Pharmaceutical Products are the world leader

Q60: A manufacturing company introduces two product alternatives.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents