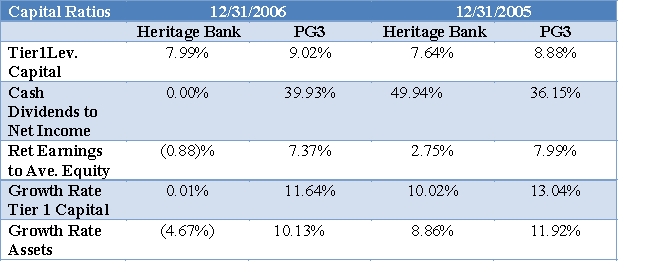

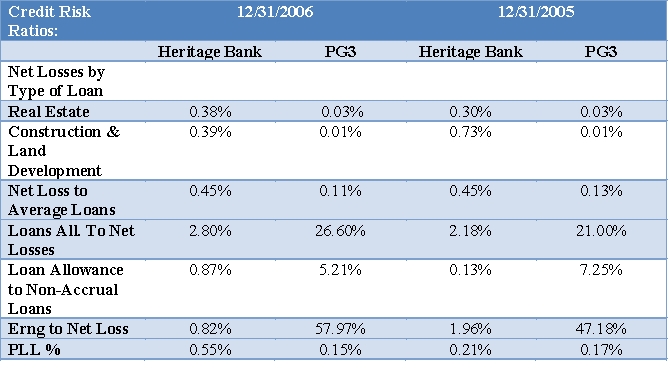

Evaluate Heritage's capital and credit using the ratios provided on the Tables below. Include in your analysis for credit risk the mix of Heritage Bank's loans shown below. Evaluate trends and compare these to the PG3. How does Heritage compare to the PG3 on respectively capital and credit risk? Cite specific ratios in your analysis.

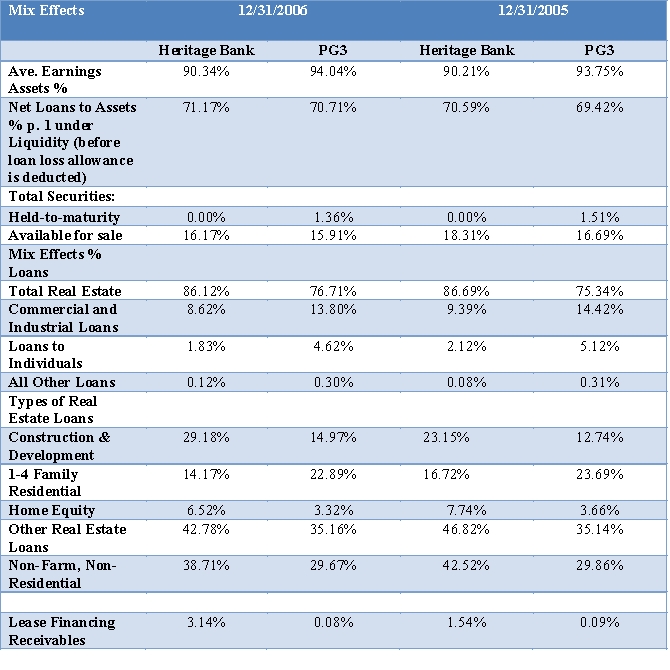

Asset Mix and Loan Mix for Heritage Bank % of average earning assets:

Asset Mix and Loan Mix for Heritage Bank % of average earning assets:

Correct Answer:

Verified

Q2: Examine the trends in the NIM and

Q3: Do a Dupont Analysis where ROA =

Q4: Burden Analysis: Analyze the trends and compare

Q5: Net Interest Margin Analysis: Evaluate rends difference

Q6: Analyze the Liability Mix and Rate

Q8: Analyze the Liquidity Risk of Heritage Bank

Q9: Conclusion: Summarize Heritage's weaknesses and strengths from

Q10: If a bank has an ROA of

Q11: The Board of Directors of the 1st

Q12: Excess reserves held by banks with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents