Assume that the economy starts at a 0% output gap. Now suppose that banks begin to fear the risk of default and the risk premium rises by 2%. Which of the following figures shows what happens in this scenario?

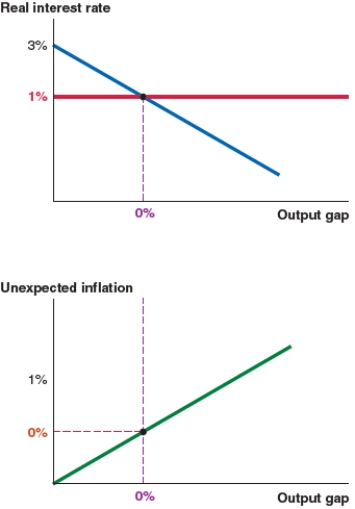

Figure A

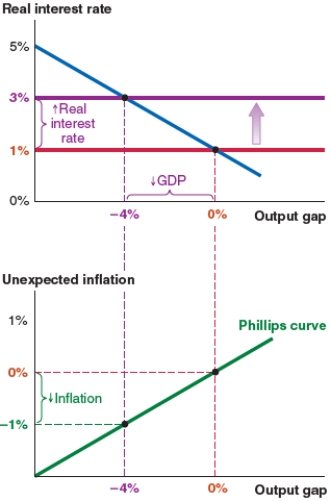

Figure B

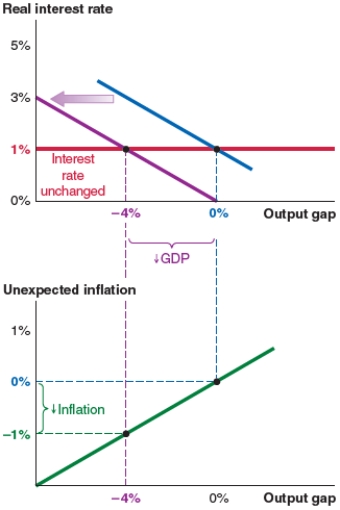

Figure C

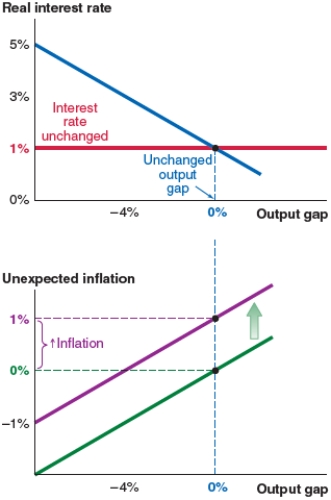

Figure D

A) Figure A (no change)

B) Figure B (an upward shift of the MP curve and a new interest rate of 3%)

C) Figure C (a leftward shift of the IS curve and an output gap of -4%)

D) Figure D (an upward shift of the Phillips curve and 1% unexpected inflation)

Correct Answer:

Verified

Q66: Which of the following graphs correctly represents

Q67: Which of the following graphs correctly represents

Q68: Which of the following graphs correctly represents

Q69: In 2017, nearly 7.6% of Vietnamese imports

Q70: In 2017, nearly 3.5% of Vietnamese imports

Q72: The economy shown here begins at a

Q73: The economy shown here begins at a

Q74: The economy shown here begins at a

Q75: The economy shown here begins at a

Q76: You are an economic adviser using the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents