Assume that a start-up manufacturing company raises capital through a series of equity issues.

Required:

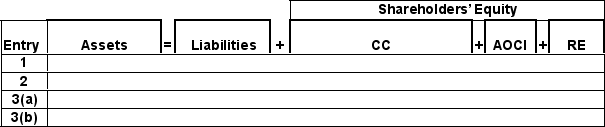

a.Using the financial statement template below,summarize the financial statement effects of the following transactions.

(1)Issues 85,000 shares of $1 par value common stock for $15.00 per share.

(2)Receives land in exchange for 8,500 shares of $1 par common stock when the common stock is trading in the market at $25 per share.The land has no readily determinable market value.

(3)(a)Receives subscriptions for the issue of 28,000 shares of $1 par value common.The share issue price is $15 of which 30 percent is received as a down payment.

(3)(b)Subsequently,the remaining 70 percent is received from the transaction in 3(a).  b.In each case,how does the company measure the transaction? What measurement

b.In each case,how does the company measure the transaction? What measurement

attribute is used?

Journal entry (optional):b.In each transaction,the company uses the attribute "fair value" as the measurement basis for the transaction.The net increase in shareholders' equity always equals the fair value of the asset received.Cash (the best measure of fair value in an arm's-length exchange)received in Transactions 1 and 3 determines the net increase in shareholders' equity.In Transaction 2,the fair value of the asset received (land)is approximated by the fair value of the common stock issued because the market price of the common stock is known and the fair value of the land is not readily determinable.

Correct Answer:

Verified

b.Journal Entry

In Transaction #3

(...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Under an operating lease agreement the lessee

Q46: The acceptable method of accounting for stock

Q56: In the chart below,assign the directional effect

Q58: In the chart below,assign the directional effect

Q60: Why can exercising stock options can create

Q61: In the chart below,assign the directional

Q62: NOTE: The following problem requires present value

Q63: NOTE: This problem requires present value information.

Charter

Q64: Summarize how the following information about Crank

Q65: Following is the shareholders' equity section

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents