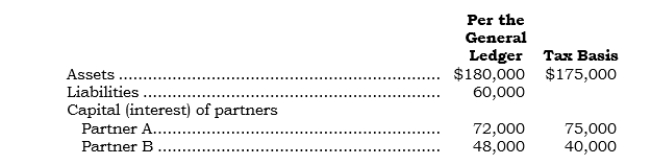

_____ Tax basis: Assume the following data for the partnership of A and B: A and B share profits and losses 75:25, respectively. C is admitted to a one-fifth interest in the capital and profits and losses of the partnership by contributing $40,000 (one-fifth of the net assets of the new firm) and assumes a one-fifth responsibility for present partnership obligations. The tax bases of A, B, and C after the admission of C are

A and B share profits and losses 75:25, respectively. C is admitted to a one-fifth interest in the capital and profits and losses of the partnership by contributing $40,000 (one-fifth of the net assets of the new firm) and assumes a one-fifth responsibility for present partnership obligations. The tax bases of A, B, and C after the admission of C are

A) $66,000, $37,000, and $52,000, respectively.

B) $69,000, $34,000, and $52,000, respectively.

C) $75,000, $40,000, and $40,000, respectively.

D) $75,000, $40,000, and $52,000, respectively.

E) $71,000, $36,000, and $48,000, respectively.

Correct Answer:

Verified

Q27: _ At 12/31/06, Reed and Quinn are

Q28: _ Diller decided to withdraw from the

Q29: _ X and Y are partners and

Q30: When a partner is admitted into a

Q31: When a partner retires from a partnership,

Q32: When a partner retires from a partnership,

Q33: A gain or loss for income tax-reporting

Q34: When a partner withdraws from a partnership,

Q35: _ When a partner withdraws from a

Q36: _ A, B, and C are in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents